The Solar Payback Online Tool is designed to give an estimation of investment assessment results for solar process heat systems.

The tool gathers in two forms technical and economic parameters, defining both the solar system and the financial framework. Results are presented both on a summary list of inputs and results in 'SUMMARY' as well as graphically via plots in 'RESULTS'.

It adresses, among others, users that may not have detailed information on a specific project and therefore provides a broad range of default values (status: 2017) to input cells, enabling a preliminary estimation of results. These default values can be overwritten and thus be adapted to own assumptions. Estimations include system yield for the selected location, upon the operating conditions selected.

Operation conditions are circumscribed to the selection of different options on load profile, operation temperature and thermal storage capacity.

Users disposing of detailed system design information might use a specific yield result, which will be used in the foregoing calculations. The same approach is used for energy costs, investment costs and debt ratio.

Content

- Technical requirements and general instructions

- Field types

- Technical Form

- Financial Information Form

- Summary

- Results

For using the Solar Payback Online Tool all the user needs is a functional Browser with internet access and the url https://iki.ise.fraunhofer.de. However, the applied Javascript Framework does not support IE8 (Internet Explorer) and below, because it uses ECMAScript 5 features that are un-shimmable in IE8. However it supports all ECMAScript 5 compliant browsers. In case the tool cannot be displayed correctly in the used Browser, the user should fall back on Chrome or Firefox.

In case the user encounters rendering problems, it might help to switch between the tool's tabs, until the specific tab is re-rendered.

This is an easy accessable tool, which is why we went without a user login. But this means inputs and results can't be saved and get lost by refreshing the browser. In order to keep the content, the user is asked to use the print function of the browser to print to paper or create a PDF. The shortcut Ctrl+P on Windows or Command+P on Apple might be helpful. It is recommended to use Chrome for this purpose.

In IKI calculation tool the user will find the different cell style. In Table 1 it is explained the meaning of each style.

Table 1: User Form, field types  Marked with * and an edit-icon | Required input field - Dropdown list, or input value (number)

- The user can find default value on this cells

- The user might insert different values (this means deleting the default value cell.

|

Grey box | Output field - Calculated results (blocked to the user)

|

Marked with an edit-icon,

black box border | Optional input field - Overrides the corresponding calculated value

- Inputs which will override default assumptions and will be taken for the calculations

|

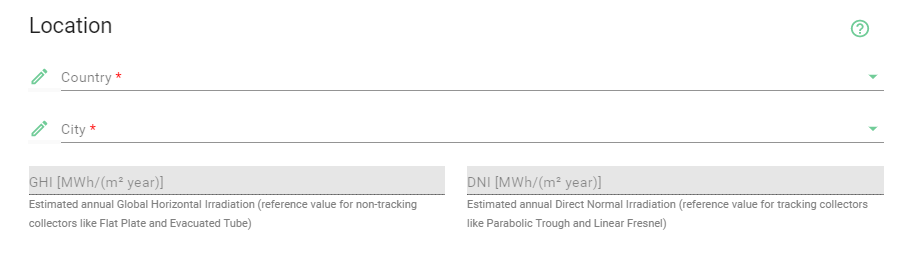

At this point, the user is requested to fill in the technical data of the current heat source and new solar thermal system. This includes location, current heat supply system, current heat load profile, solar thermal system definitions and solar field area definitions. In some of the fields marked by the edit-icon there are default values, adapted to the user's input, that can be used for the forward financial calculations. The user has always the option to change the value/parameter in these cells.

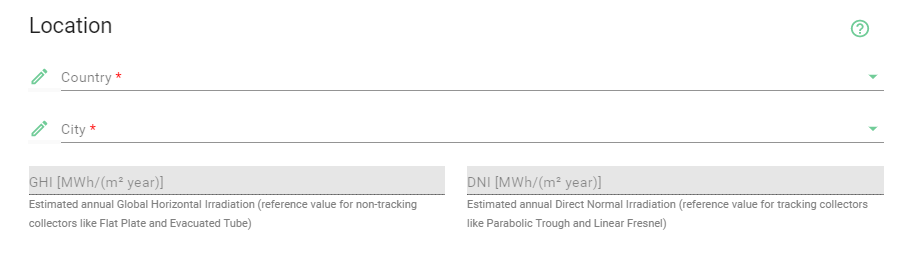

Fig. 1: Technical Information - Location

Fig. 1: Technical Information - Location At first the user can choose the geographical location of the system, under “Country” and then “City”, as shown in Fig. 1. According to it, the “Estimated Annual Direct Normal Irradiation" or "Estimated Annual Global Horizontal Irradiation" will be calculated. The data source for Irradiation data stems from Meteonorm database.

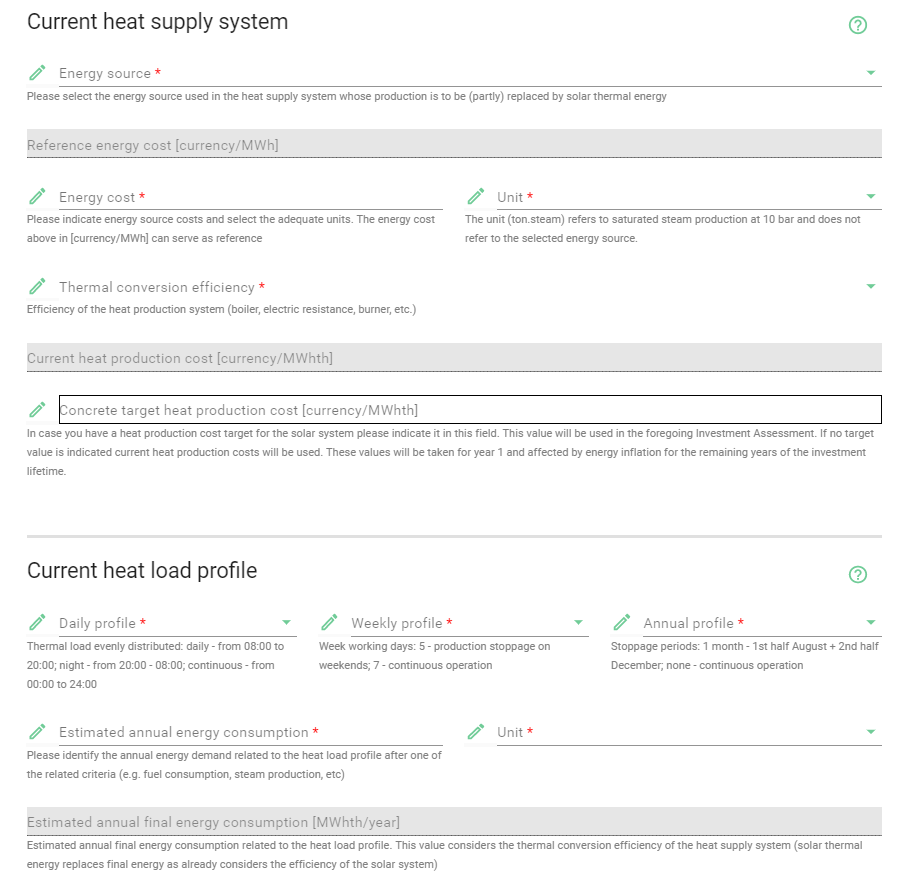

Fig. 2: Technical Information – Current heat supply system and Current heat load profile

Fig. 2: Technical Information – Current heat supply system and Current heat load profile Here, Fig. 2, details can be given about the user current heat supply system and heat load profile. Under “Energy Source”;, the user can insert or maintain the energy source used in the heat supply system whose production is to be (partly) replaced by solar thermal energy.

“Reference Energy Cost”; is an estimation of the cost of the selected energy source in the selected country (research status: 2019).

“Energy Costs” relates to the actual energy source costs of the heat production system. The “reference energy cost” can serve as aid. Afterwards, please select its units accordingly.

The “Thermal conversion efficiency” relates to the efficiency of the heat production system (e.g., boiler, electric resistance, burner, etc.).

The “Concrete target heat production costs” can be inserted in case the user has a heat production cost target for the solar system. This value will be used in the foregoing Investment Assessment. If no target value is indicated current heat production costs will be used. These values will be taken for year 1 and affected by energy inflation for the remaining years of the investment lifetime.

In “Current heat load profile” the user can select the more suitable daily, weekly and annual profile. The load profile selected should be the one approaching better the foreseen operating conditions for the real system. The results obtained for detailed system simulations, with real load profiles, might be used in the foregoing field “Detailed Simulation Results” which will override yield estimations based on the load profile selections.

The daily profile, where the daily thermal load is evenly distributed, according to the following working schedules:

- Daily: from 08:00 to 20:00

- Night: from 20:00 to 08:00

- Continuous: from 00:00 to 24:00

The weekly profile:

- 5 days/week: 5 days production and stoppage on weekends

- 7 days/week: continuous operation

The annual profile:

- 1 Month Stoppage: production stops at the first half of august and second half of December

- Continuous: no stops in production

At the end, the user is requested to insert the “Estimated annual energy consumption”. It is related to the heat load profile after one of the related criteria (e.g. fuel consumption, steam production, etc.). Afterwards, please select its units accordingly.

Finally, the “Estimated annual final energy consumption” is calculated, upon the input on “Estimated annual energy consumption” and considering the thermal conversion efficiency of the heat supply system (solar thermal energy replaces final energy as already considers the efficiency of the solar system).

Note: “ton.steam” refers to saturated steam production at 10 bar.

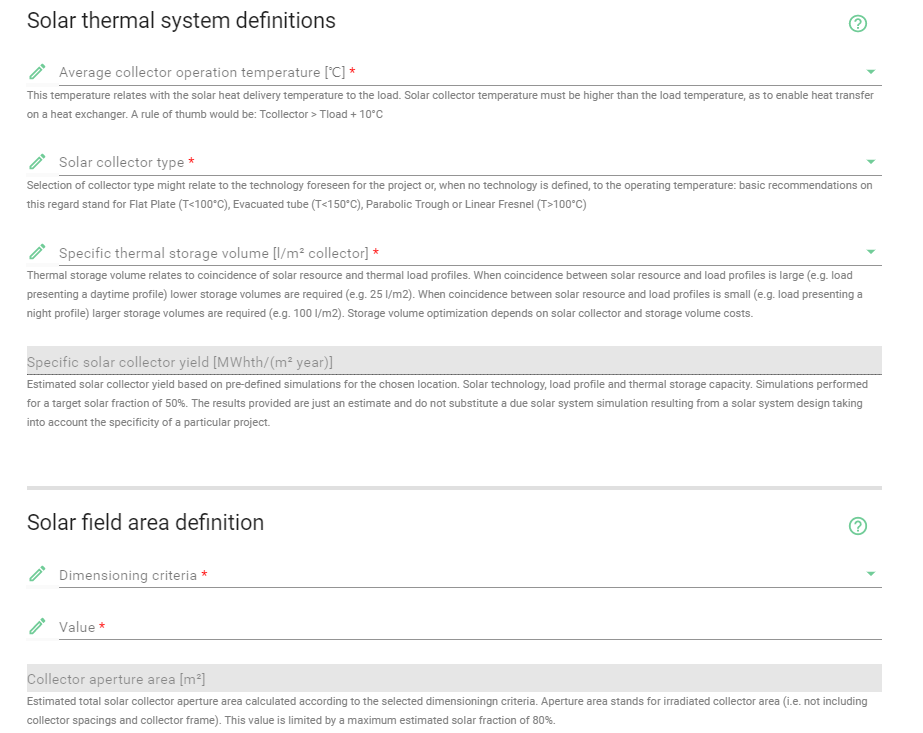

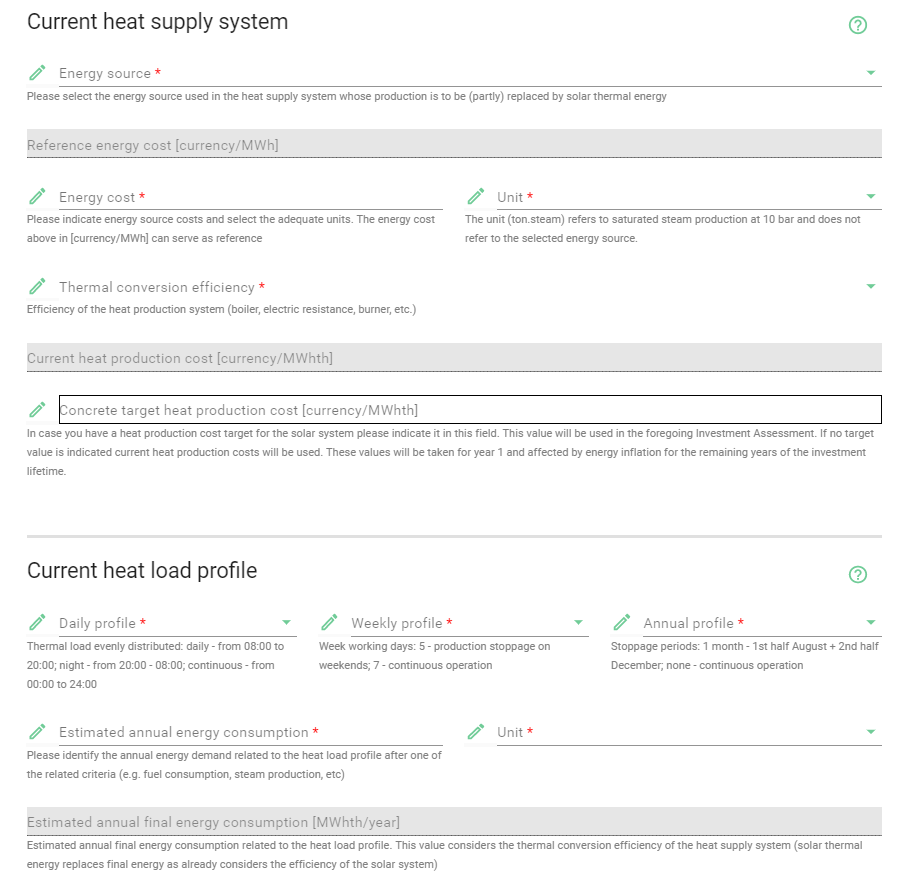

Fig. 3: Technical Information - Solar Thermal system definitions and Solar field area definition

Fig. 3: Technical Information - Solar Thermal system definitions and Solar field area definition At this stage, the user is asked to insert parameters that will be relevant for the design of the solar thermal system, see Fig. 3.

The “Average operation temperature” relates with the solar heat delivery temperature to the load. Solar collector temperature must be higher than the load temperature, as to enable heat transfer on a heat exchanger. The user can use as rule of thumb: Temperature of the collector must be at least 10 °C higher than the temperature of the load.

For the simulations return temperatures were correlated to the operation temperature levels. Further the heat transfer fluid in the system changes with the temperature level from 100°C or higher from water to thermal oil:

- Inlet 50°C - Return 20 °C; water

- Inlet 75°C - Return 40 °C; water

- Inlet 100°C - Return 50 °C; thermal oil

- Inlet 150°C - Return 80 °C; thermal oil

- Inlet 200°C - Return 100 °C; thermal oil

The selection of the “Solar collector type” might relate to the technology foreseen for the project or, when no technology is defined, to the operating temperature, for example:

- Flat plate collector (Temperature < 100 °C)

- Evacuated tube collector (Temperature < 150 °C)

- Parabolic Trough or Linear Fresnel ( Temperature > 100 °C)

The “Specific thermal storage volume” relates to coincidence of solar resource and thermal load profiles. When coincidence between solar resource and load profiles is large (e.g. load presenting a daily profile) lower storage volume is required (25 l/m2). When coincidence between solar resource and load profiles is small (e.g. load presenting a night profile) larger storage volumes are required (e.g. 100 l/m2). Besides the volume, the storage heat capacity depends on the specific heat capacity of the fluid, as well as the temperature shift (density of oil and water is rather similar).

Higher temperature levels require for thermal oil, of which the specific heat capacity is only about half of the heat capacity of water. This leads to the conclusion to double the storage size for compensation. However, at the same time, the temperature shift increases with the operation temperature level (see section “Average operation temperature”), which is rather an indication of a smaller storage size. Storage volume optimization depends on solar collector and storage volume costs (not foreseen in this simplified tool).

The “Specific solar collector yield” is an estimation based on pre-defined simulations for the chosen location, Solar technology, load profile and thermal storage capacity. For the sake of comparativeness of results, simulations are performed for a target solar fraction of 50%. The results provided are just an estimation and do not substitute a due solar system simulation resulting from a solar system design taking into account the specificity of a particular project.

Under “Solar field area definition” the user can decide for the dimensioning criteria. The dimension criteria are:

- Available area (m2)

- Target solar fraction (%)

- Target peak power (MW)

- Solar collector aperture area (m2)

The most accurate results will be achieved by indicating a precise total solar collector aperture area. For the remaining dimensioning criteria assumptions are taken to calculate effective collector area.

At the end, the “Collector aperture area” is calculated according to the selected dimensioning criteria.

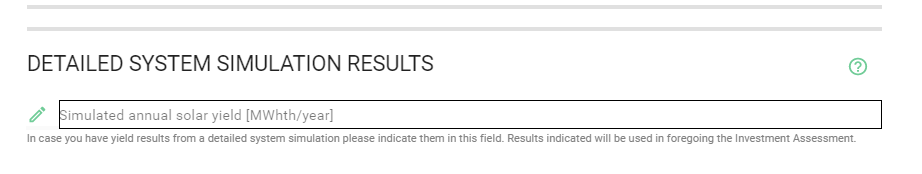

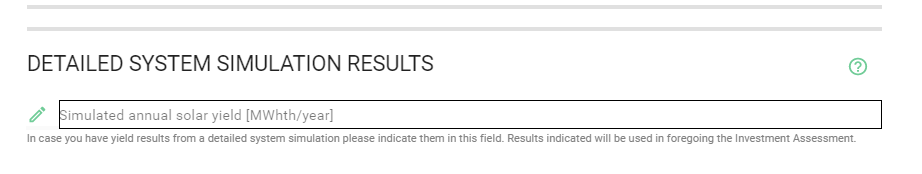

Fig. 4: Technical information - Detailed system simulation results (optional)

Fig. 4: Technical information - Detailed system simulation results (optional) In case the user has yield results from a detailed system simulation; it can be introduced in “Simulated annual solar yield”, Fig. 4. The indicated value will then be used in foregoing the Investment assessment and previous calculated values (light red) will then be ignored.

Once the technical form is filled in, the user has to “submit” it. By this a validation of the inserted values is made. Not valid or missing inputs are marked red and have to be corrected. Once all fields are valid, the form has to be “submitted” again. Is the form valid, the user is forwarded to the next tab “Financial Information Form”. With each change of inputs in the form, it has to be submitted again in order to achieve results.

In the Information Form the user is enabled to fill in relevant information for the investment assessment.

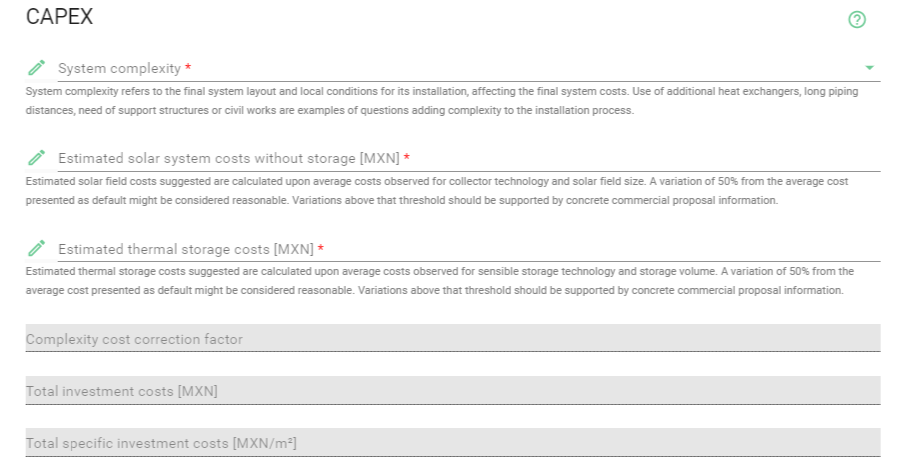

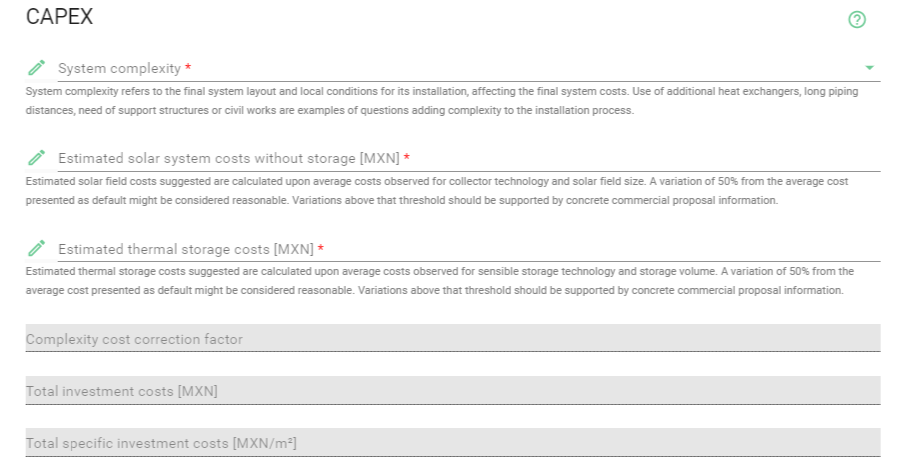

Fig. 5a: Financial Information - CAPEX - Mexico [Mexican Peso MXN]

Fig. 5a: Financial Information - CAPEX - Mexico [Mexican Peso MXN]  Fig. 5b: Financial Information - CAPEX - South Africa [South African Rands ZAR]

Fig. 5b: Financial Information - CAPEX - South Africa [South African Rands ZAR] In “CAPEX”, Fig. 5, the “Estimated solar system costs without storage” are calculated upon average costs observed for collector technology and solar field size (research status: 2017). The country and technology specific default value is influenced by three correction parameters – temperature, size and complexity.

Temperature and size are already entered in the technical information form. “System complexity” is divided under the criteria: Simple, Somehow complex, Complex and Very complex. It refers to the final system layout and local conditions for its installation, affecting the final system costs. Installation costs will for instance differ greatly depending on where and how the collectors can be installed or integrated on the building, the need of support structures of civil works, how long the pipe runs are and the use of additional heat exchangers. The three parameters are correlated with a correction factor, which adjust the solar system costs without storage according to the selection made. A predefined cost framework prevents minimum and maximum values from being exceeded with this procedure.

The total investment costs include the estimated solar system costs and the estimated thermal storage costs. The “Estimated thermal storage costs” are suggested as default and calculated upon average costs observed for sensible storage technology and storage volume (research status: 2017). A variation of 50 % from the average costs presented as default might be considered reasonable. Variation above that threshold should be supported by concrete commercial proposal information.

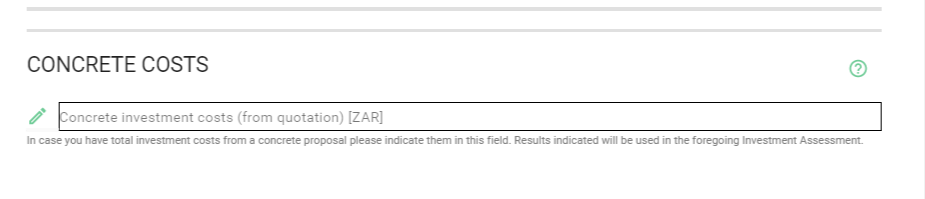

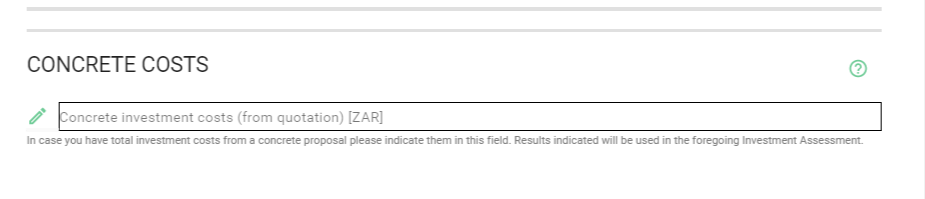

Fig. 6: Concrete Costs (OPTIONAL)

Fig. 6: Concrete Costs (OPTIONAL) Alternatively, the user has the option to insert a concrete value for the investment costs (including storage costs), Fig. 6, e.g. if concrete commercial proposal information from a technology supplier is already available. Results indicated will be used in the foregoing investment assessment

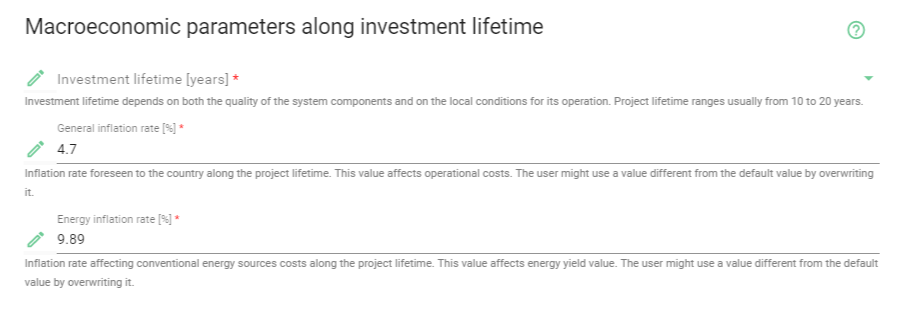

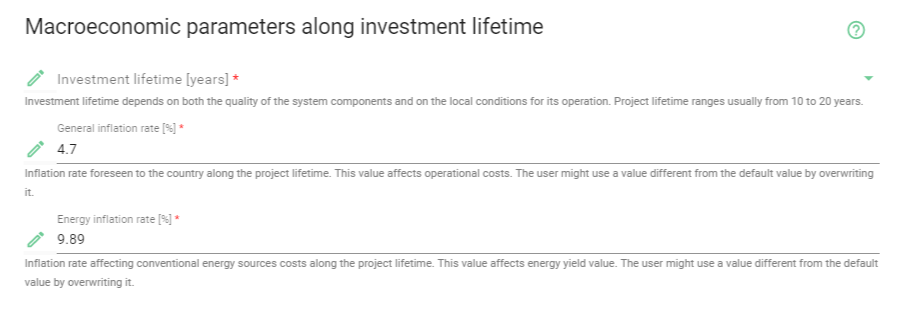

Fig. 7: Financial Information - Macroeconomic parameters along investment lifetime

Fig. 7: Financial Information - Macroeconomic parameters along investment lifetime In “Macroeconomic parameters along investment lifetime”, Fig. 7, the “Investment lifetime” depends on both the quality of the system components and with the local conditions for its operation. Investment lifetime ranges usually from 10 to 20 years.

The “General Inflation rate” is foreseen to the country selected in the “Technical Form” along the project lifetime. This value affects operational costs. The value is updated on a regular basis, however, the default value (research status: 2017) can be overwritten by the user in case more recent data is available.

The “Energy inflation rate” is foreseen to the country selected and affects market prices of conventional energy sources and the according costs for conventional energy sources along the project lifetime. The default value is based on energy inflation rates in the past (research status: 2017, no forecast scenario) and affects the energy yield value. The user can overwrite the value, if he has more precise data on the inflation of a certain fuel. Furthermore, industrial companies often have long-term contracts with their suppliers in which the development of the conventional fuel price is fixed/foreseen over the duration of the project.

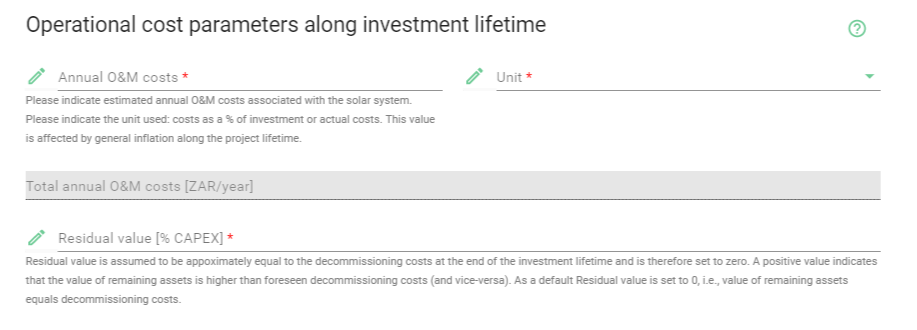

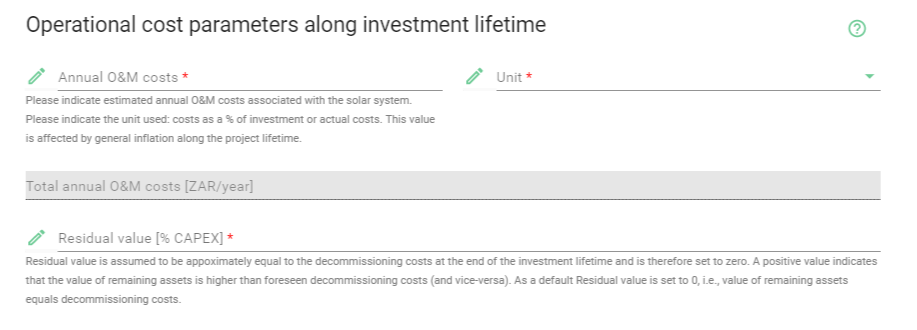

Fig. 8: Financial Information - Operational cost parameters along investment lifetime

Fig. 8: Financial Information - Operational cost parameters along investment lifetime In “Operational costs parameters along investment lifetime”, Fig. 8, the user is requested to insert the “Annual O&M costs” associated with the solar system as well as to indicate the unit used: costs as a percentage of investment (% CAPEX) or actual costs (Country Currency), this can be selected in the dropdown list signed with an arrow. A proper default value for the annual O&M costs is 3 % of the CAPEX.

The “Residual value” is assumed to be approximately equal to the decommissioning costs at the end of the investment lifetime and is therefore set to zero. The user can adjust this value in function of the project characteristics. A positive value indicates that the remaining assets value is higher than foreseen decommissioning costs (and vice-versa). As a default residual value is set to 0, i.e. remaining assets value equals decommissioning costs.

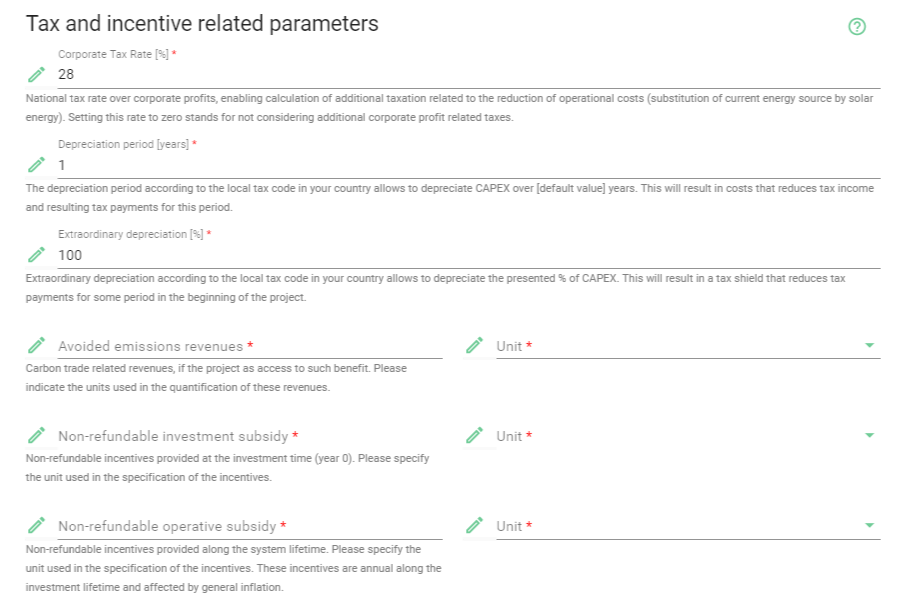

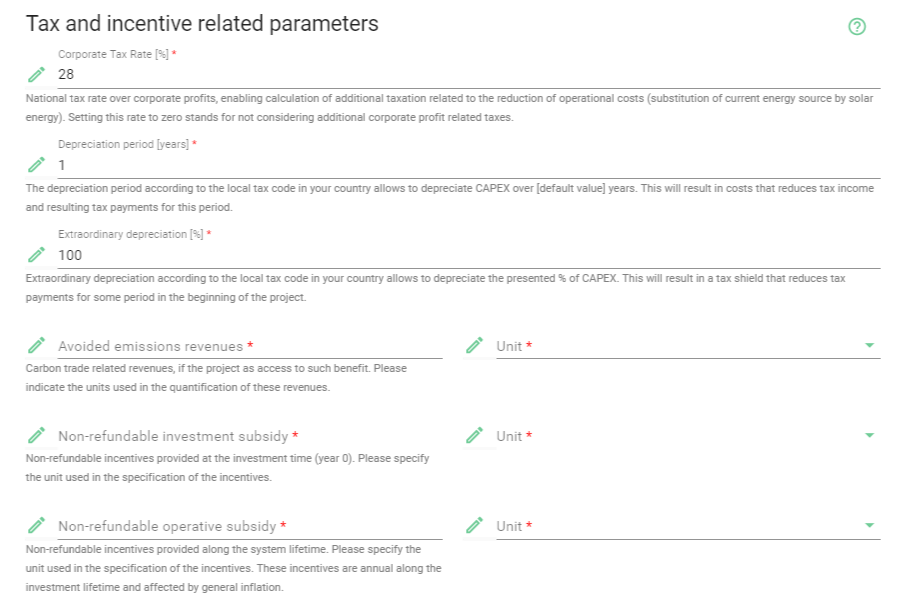

Fig. 9: Financial Information - Tax Incentives related parameters

Fig. 9: Financial Information - Tax Incentives related parameters The section “Tax and Incentives related parameters”, Fig. 9, covers tax-related incentives as well as avoided emissions revenues and subsidies. All values are set by default according to the current local framework conditions (research status: 2017). They can be changed by the user to reflect special circumstances or to display different scenarios.

The “Corporate Tax rate” is the National tax rate over corporate profits, enabling calculation of additional taxation related to the reduction of operational costs (substitution of current energy source by solar energy). Setting this rate to zero stands for not considering additional corporate profit related taxes. The “Depreciation period” according to the local tax code in the country allows to depreciate investment costs linearly over a given number of years. This results in costs that reduce taxable income and therefore the resulting tax payments for this period. The “Extraordinary Depreciation” according to the local tax code allows to depreciate the presented % of CAPEX in the investment year. This will result in a tax shield that reduces tax payments for some period in the beginning of the project. SHIP promotion policies could shorten depreciation periods for long lasting assets or increase extraordinary depreciation rates. The higher the extraordinary depreciation the shorter the depreciation period, the higher and longer lasts the tax shelter that postpones tax payments. Note that the economic residual value, that is paid by a third party for purchasing the used asset is independent of the depreciated amount. (research status: 2017)

Additionally to the tax related fields, the user can adjust the following default values: The “Avoided emmisions revenues” are related with Carbon trade revenues, if the project has access to such benefit. The “Non-refundable investment subsidy” is related to Non-refundable incentives at the investment time (year 0) and can be indicated. The “Non-refundable operative subsidies” are non-refundable incentives provided along the system lifetime. These incentives are annual along the investment lifetime and affected by general inflation. Please always indicate the units used in the quantification of these values (dropdown cell).

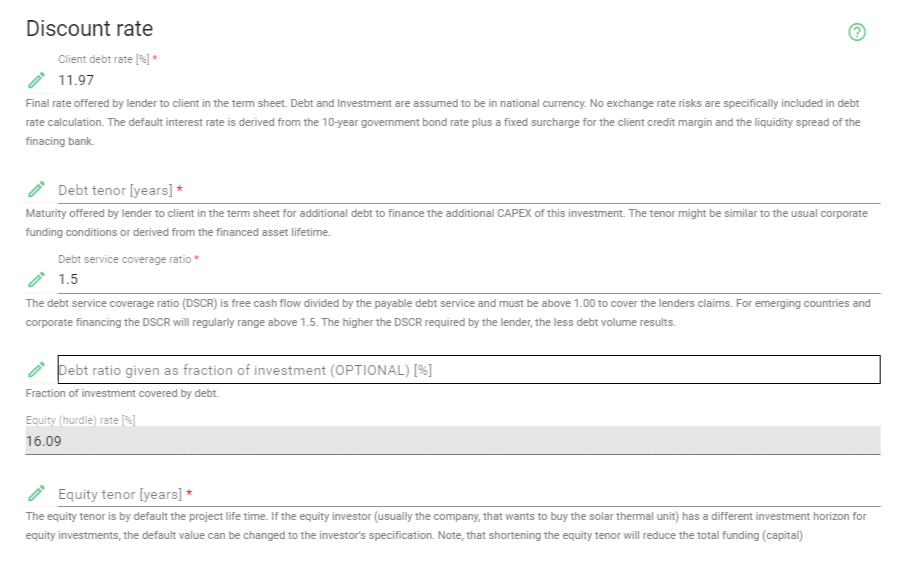

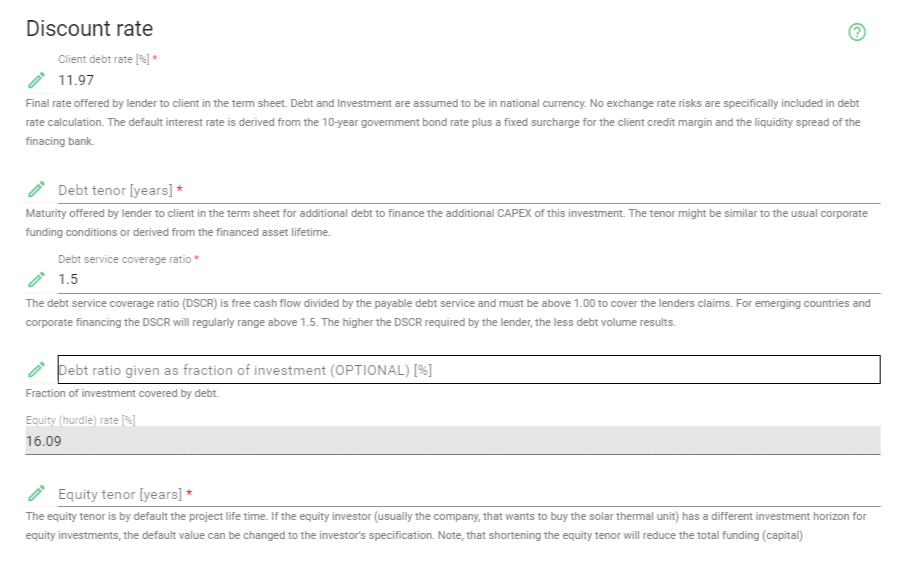

Fig. 10: Financial Information - Discount rate

Fig. 10: Financial Information - Discount rate Under “Discount rate”, Fig. 10, the user can adjust some default values. The “client debt rate” is the final rate offered by the lender to the client in the term sheet. Debt and Investment are assured to be in national currency. No exchange rate risks are specifically included in debt rate calculation. The default interest rate is derived from the 10-year government bond rate plus a fixed surcharge for the client credit margin and the liquidity spread if the financing bank (research status: 2017). The “Debt tenor” is the maturity offered by the lender to the client in the term sheet for additional debt to finance the additional CAPEX of this investment. The tenor might be similar to the usual corporate funding conditions or derived from the financed asset lifetime. The “Debt Service Coverage ratio” or DSCR is free cash flow divided by the payable debt service and must be above 1.00 to cover the lenders claims. For emerging countries and corporate financing the DSCR will regularly range above 1.5. The higher the DSCR required by the lender, the less debt volume results. In function of these values the “Estimated maximum Debt ratio” is calculated, the fraction of the investment covered by debt.

“Debt ratio (sources of funds)” (this value can be found in SUMMARY) The debt ratio is defined as debt divided by capital (equal to capital as the sum of debt and equity). The amount of debt results from the debt financing conditions (debt-rate & -tenor and DSCR) and the project cash flows, specifically the cash available to debt service (CADS). If these market values are unknown, alternatively a given debt ratio can be assumed. As alternative the user can simply insert in “Debt ratio given as fraction of investment (OPTIONAL)” the user fraction of the investment covered by debt. This will be taken for forward calculations instead of the “Debt ratio (sources of funds)”.

Depending on whether the debt ratio is derived from the value of the asset or relates to the investment costs, the equity ratio changes accordingly.

In the market value approach, equity is the value of an asset less the amount of all liabilities on that asset. The model assumes that the “Equity (Hurdle) rate” is the all-in interest rate a specific company/investor requires from its investments. A hurdle rate is the minimum rate of return on a project or investment required by a manager or investor. The hurdle rate denotes appropriate compensation for the level of risk present; riskier projects generally have higher hurdle rates than those that are deemed to be less risky. The default rate is derived from the 10-yr government bond rate plus the country equity interest rate premium (research status: 2017).

If a debt ratio is specified by the user, the return on the investment is no longer specified by the equity hurdle rate. Furthermore, this approach works with book values and does therefore not consider a project margin.

The “Equity tenor” is by default the project lifetime. If the equity investor (usually the company that wants to buy the solar thermal unit) has a different investment horizon for the equity investments, the default value can be changed to the investor’s specifications. Note: Shortening the equity tenor will reduce the total funding (capital).

The calculated “Effective costs of capital” (COC) (this value can be found in SUMMARY) is the rate of return of all cash flows necessary to honor the capital requirements of debt and equity, including payments of interests, repayments and fees that account for a change in the relations of debt to equity funding, called leverage, over the lifetime of the project (COC differ from WACC as the later will only account for interest payments and assumes constant leverage. COC will regularly exceed WACC and discounting with WACC will overestimate the project value and project margin. Overestimation can be partially offset using COC for the project valuation and discounting project cash flows.).

Once the financial information form is filled in, the user has to “submit” it. By this a validation of the inserted values is made. Not valid or missing inputs are marked red and have to be corrected. Once all fields are valid, the form has to be submitted again. Is the form valid, the user is forwarded to the next tab “Summary”. With each change of inputs in the form, it has to be submitted again in order to achieve results.

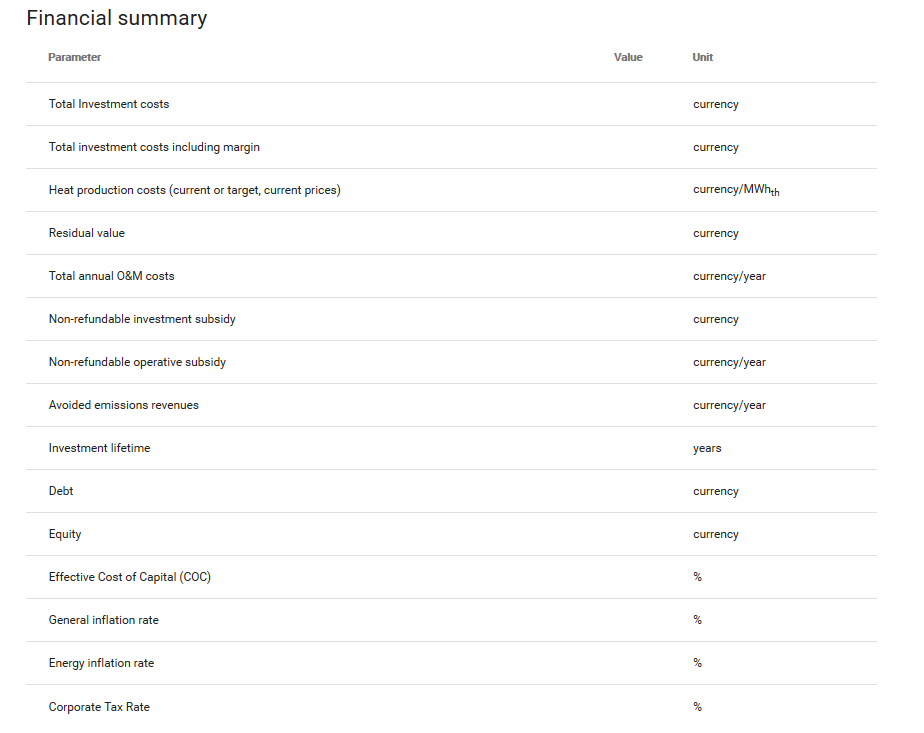

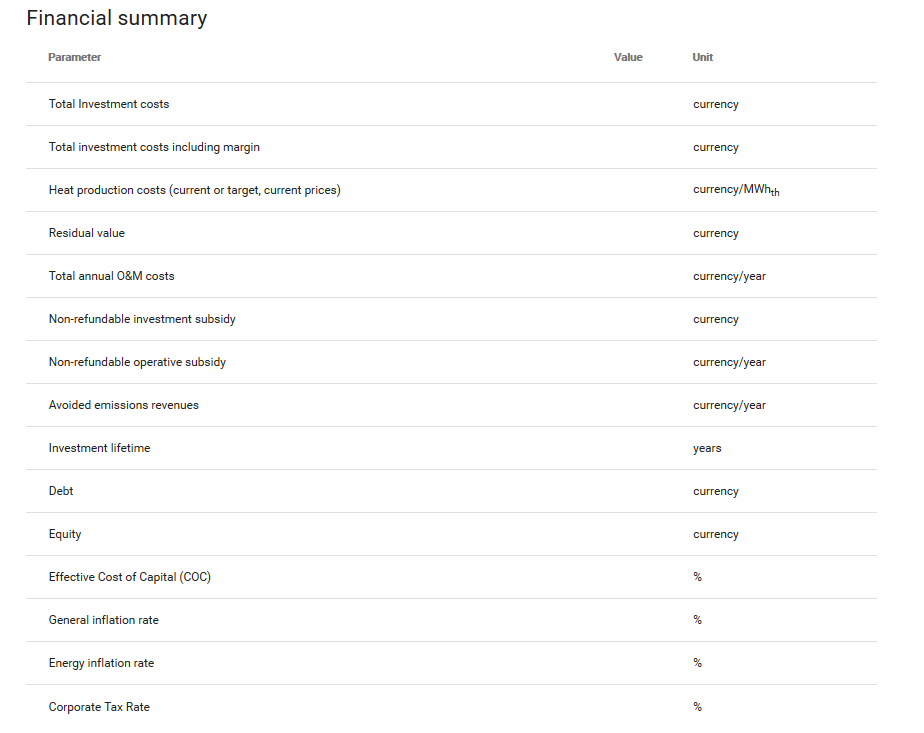

Under “SUMMARY” a table of inputs and results can be found. In order to get results, the button “Calculate investment” must be clicked. This button is disabled, as long as the both forms, Technical and Financial Information are not submitted correctly. A comment indicates which form is missing. Please note, that with each change in inputs, the corresponding form has to be re-submitted and the “Calculate investment” clicked again. With the first click on the button after fresh load of the tool, our Terms and Conditions have to be agreed on. Without the agreement, no results can be obtained.

Fig. 11 and Fig. 12, the user can verify the information previously given in “Technical Form”, and in “Financial Form”. If necessary, the user can go back and adjust previous values, before conferring the Investment assessment results in next tables.

Fig. 11: Technnical summary

Fig. 11: Technnical summary  Fig. 12: Financial Summary

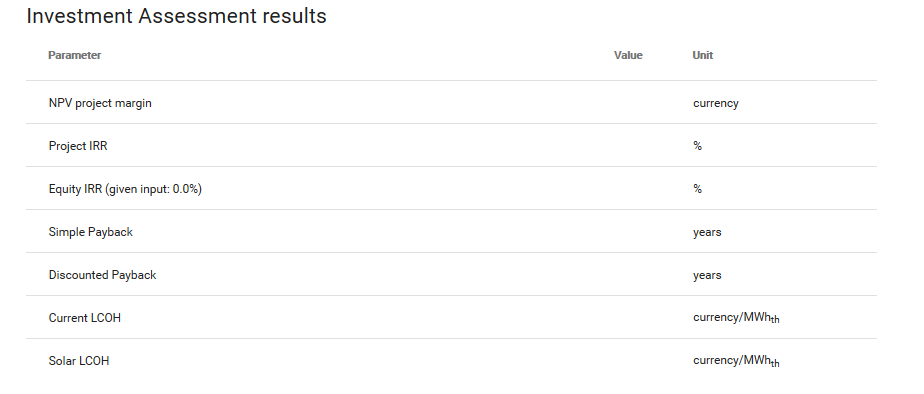

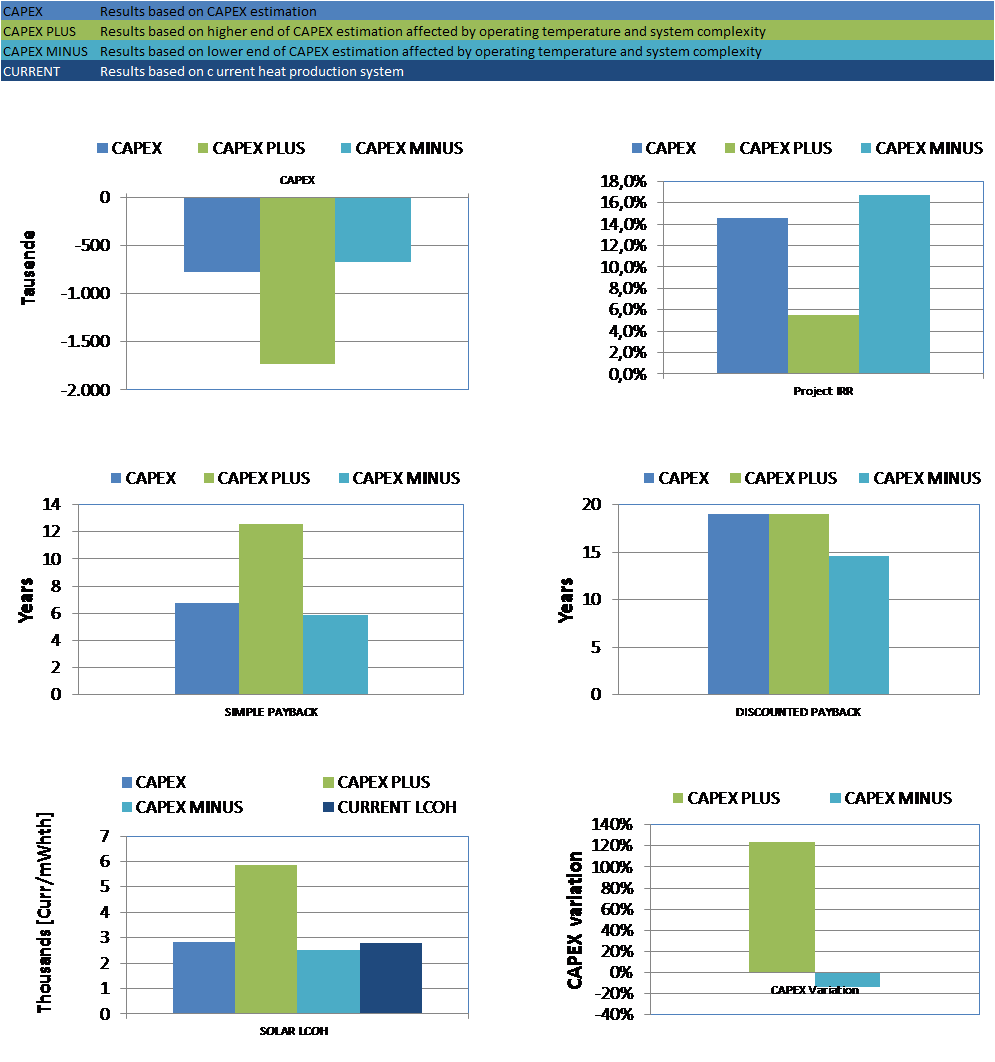

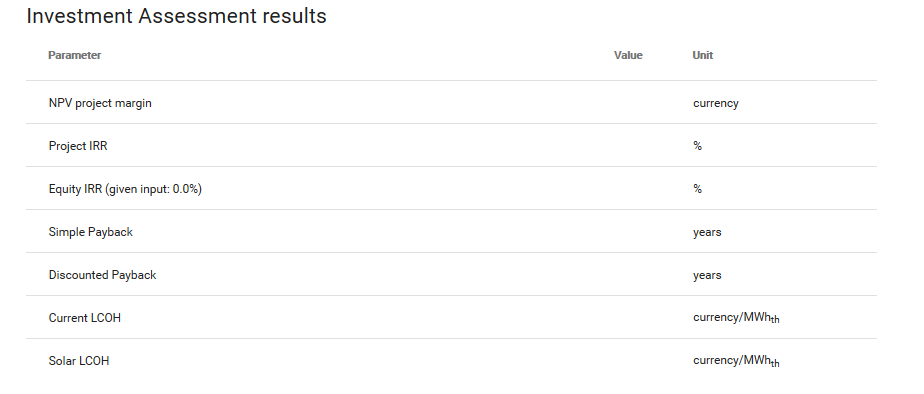

Fig. 12: Financial Summary At first, in “Investment Assessment results”, Fig. 13, the “NPV Project Margin” (Net Present value) is presented to the user. It analyses the profitability of a projected investment based on the Net Present Value, this means the difference between the present value of cash inflows and the present value of cash outflows, having in account that money in the present is worth more than the same amount in the future. A positive NPV means that the project generates revenues above the capital costs (CAPEX).

The “Project IRR” (Internal rate of return) stands for the maximum actualization rate under which the NPV becomes 0. When the IRR exceeds the discount rate, the standard decision rule is to accept the project.

As mentioned above, the “Equity IRR” is assumed to be the equity hurdle rate for the market value approach. In case of a user defined debt ratio, this assumption becomes invalid.

The “Simple Payback” provides the time necessary until an investment is paid back having in account the present value of the money (i.e., based on non-discounted cash flows).

The “Discounted Payback” provides the time necessary until an investment is paid back having in account the time value of money. This principle implies that the discounted payback period is longer than the simple payback period, but also that the former makes a more accurate estimate of when a return on investment is to expect for an investor.

The “Current LCOH” (levelized cost of heat) measures lifetime costs divided by heat production. This represents the price paid per each MWh heat produced by the current heat source system. Thus, the “Solar LCOH” represents the price paid pear each KWh heat produced by the solar thermal system previously selected. Both the LCOH takes in account all the solar thermal system or current system CAPEX (Capital Costs) including solar field and energy storage. It also includes operation (O) and maintenance (M) cost to run the system and actual energy costs for the lifetime of the plant.

Fig. 13: Investment Assessment results

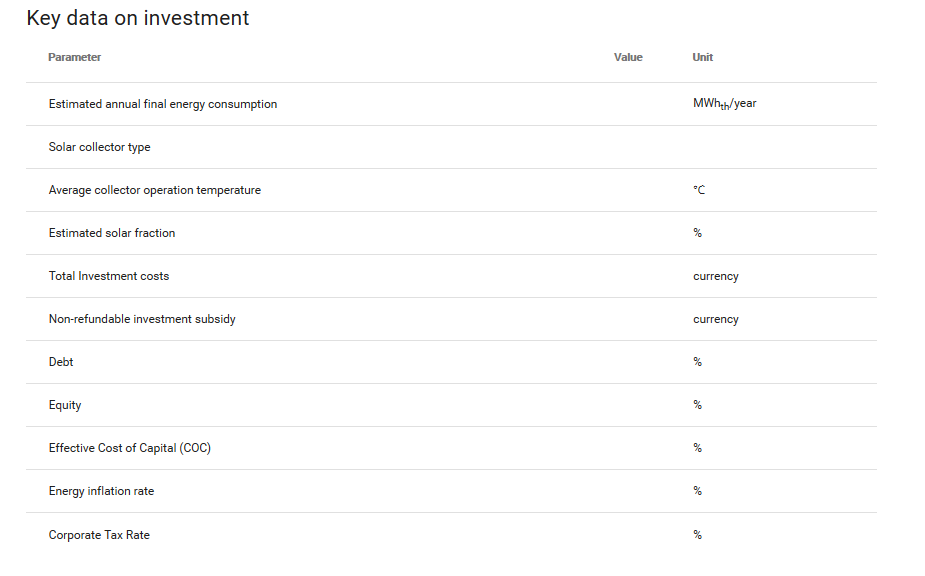

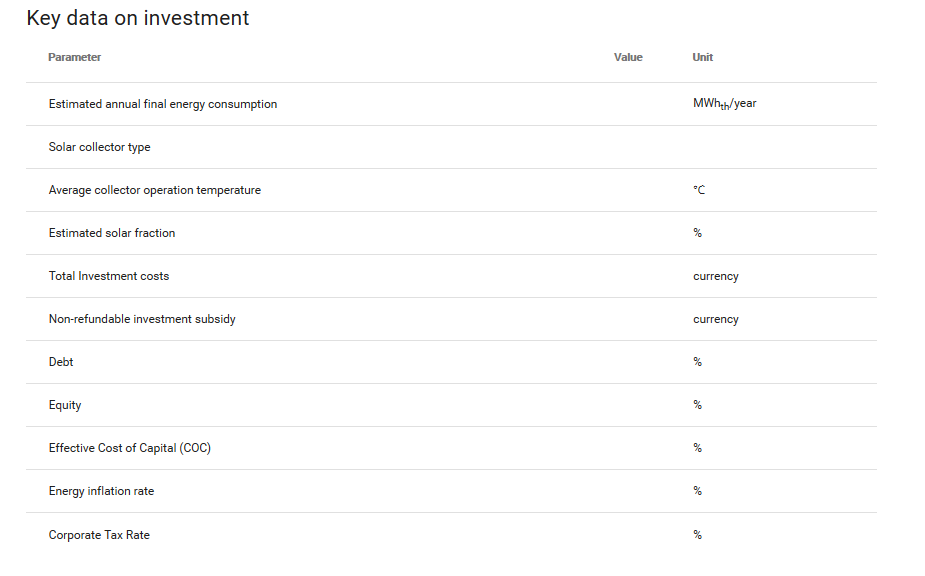

Fig. 13: Investment Assessment results In the table “Key data on Investment”, Fig. 14, the tecno-economic summary of the project is given.

Fig. 14: Key data on investment

Fig. 14: Key data on investment Please note: If changes in one of the two forgoing forms are made, the results in the table are reset and the “Calculate Investment” button is disabled again. The corresponding form has to be re-submitted and a new calculation has to be performed by clicking the button again.

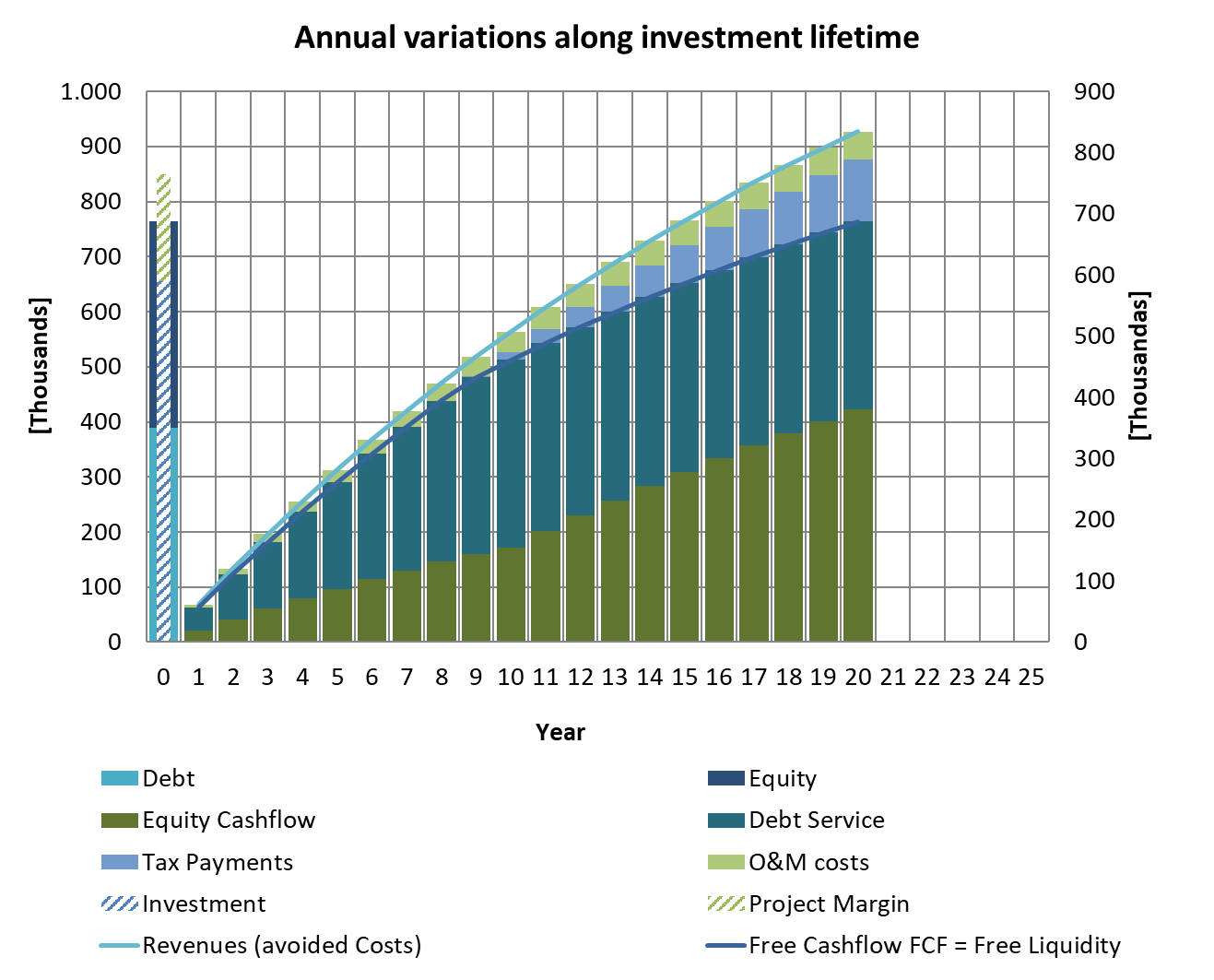

Here the calculation results can be displayed in graphs by clicking the buttons “Show annual graphs” and “Show variations graphs”. These buttons are disabled as long as there are no valid results available. These results are obtained by clicking the “Calculate Investment” button in “Summary” (please see notes in section “Summary”).

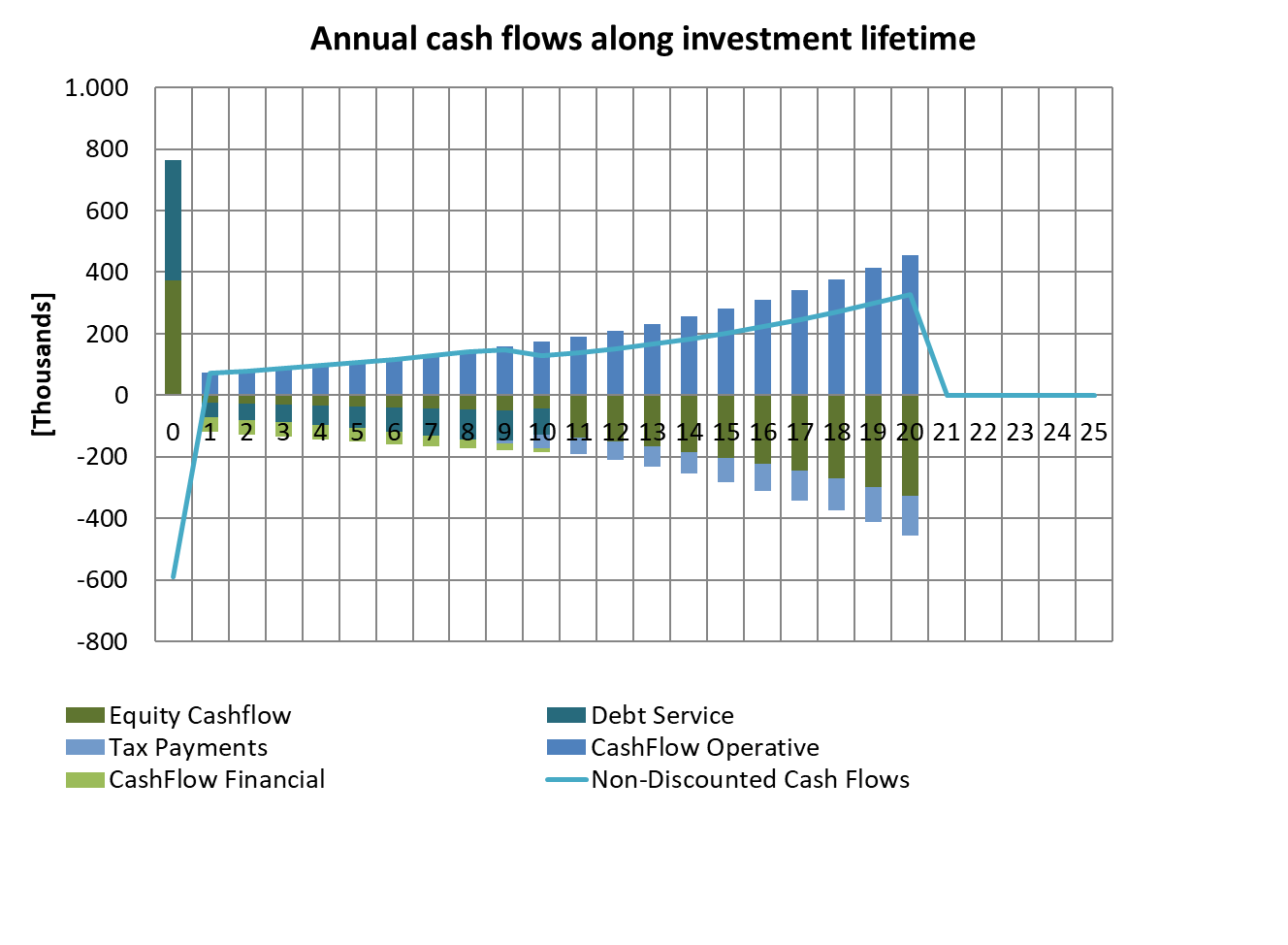

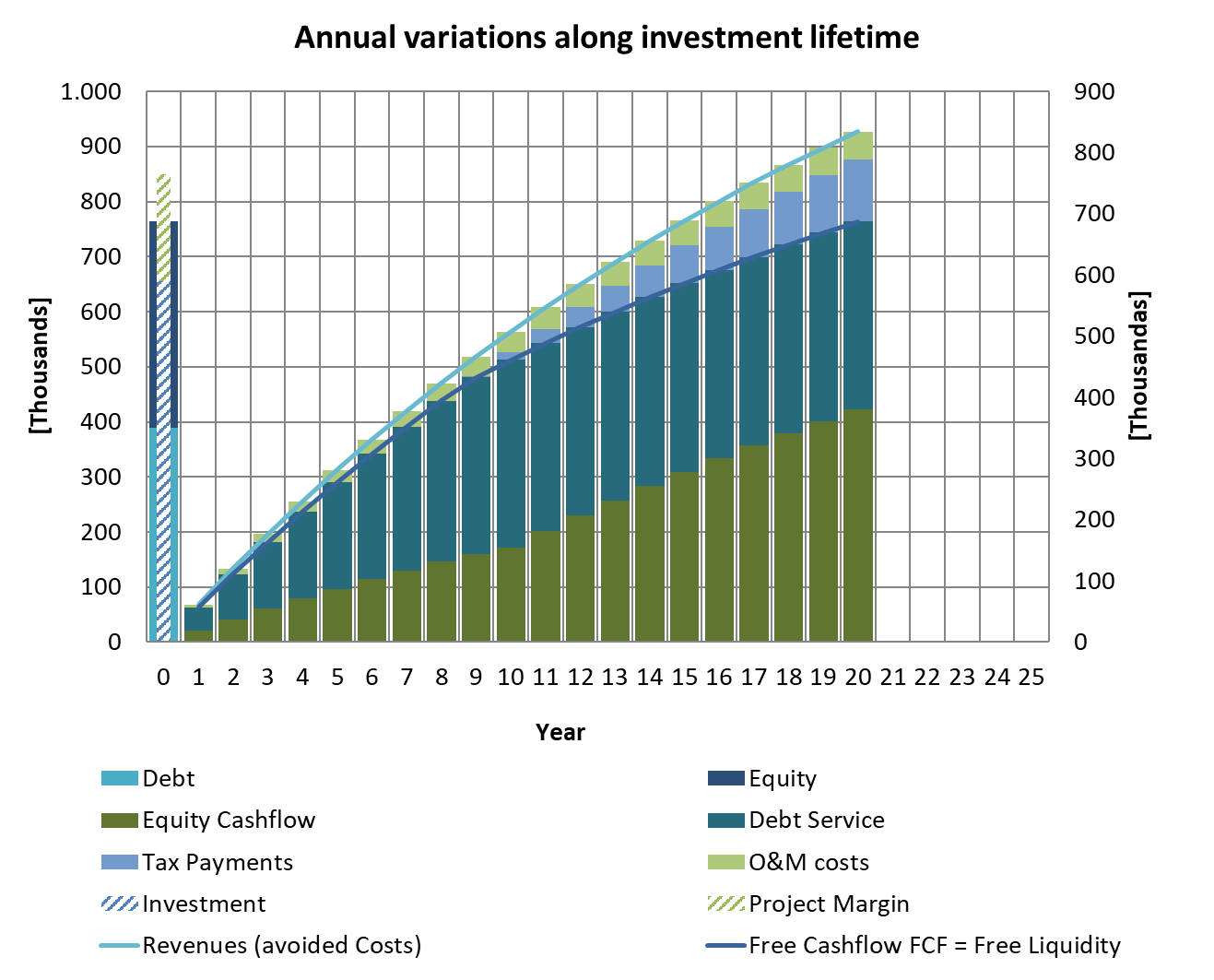

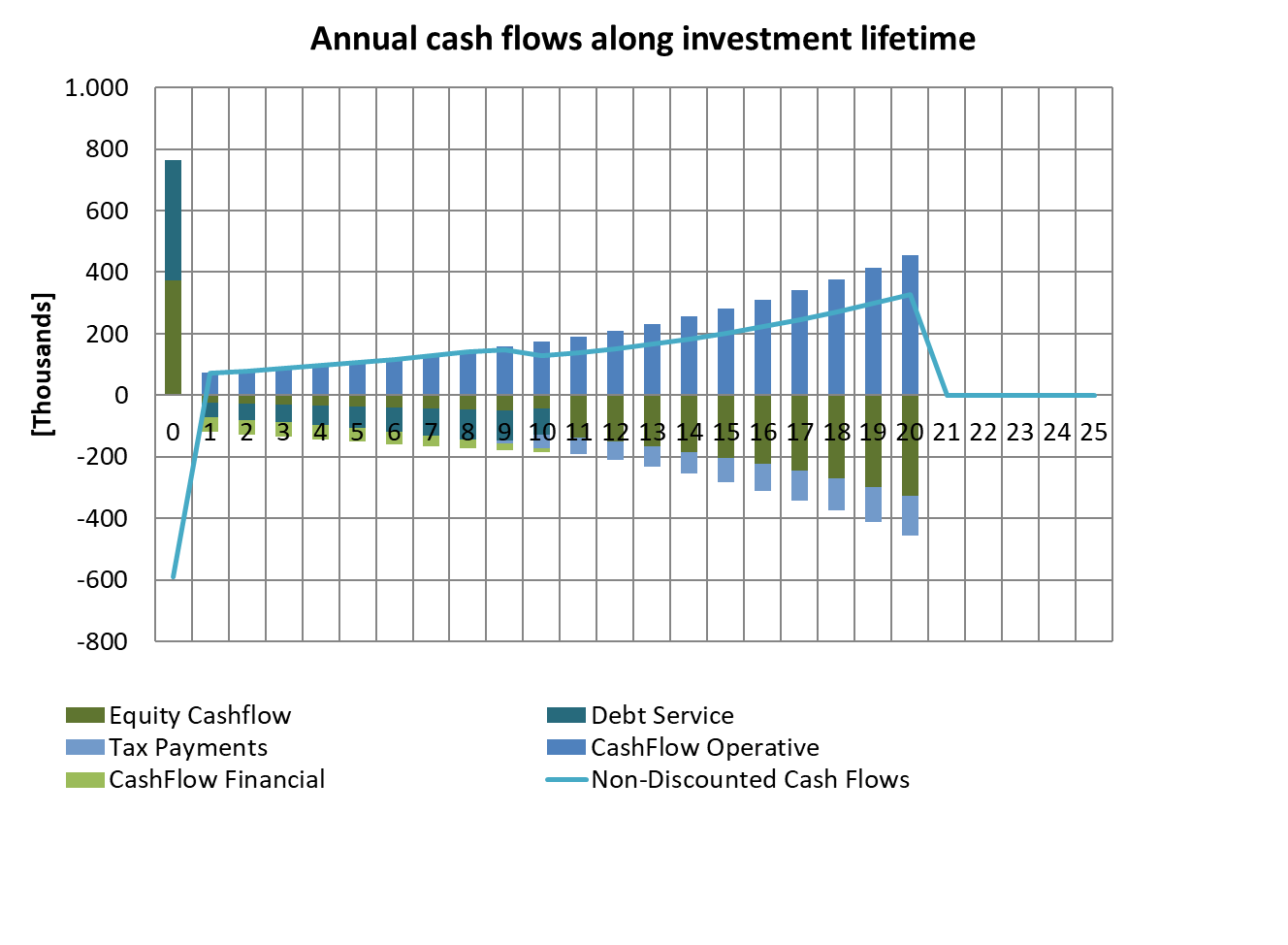

The following graph, Fig. 15 and Fig. 16, presents the cash flows (for each year or accumulated, this means the sum of the present year with the past years) in Millions (currency according to the country selected in the “Technical Information Form”).

Fig. 15: Annual variation along investment lifetime

Fig. 15: Annual variation along investment lifetime  Fig. 16: Annual cash flows along investment lifetime

Fig. 16: Annual cash flows along investment lifetime A cash flow considers yearly income and expenditure. The cash flow from investing activities includes the “investment”, specifying how the latter is financed by “equity” and “debt”. The operative cash flow comprises “revenues” in the form of net energy costs savings for the company per year with the solar thermal system. The operative cash flow diminished by “O&M costs” and adjusted for “Tax payments” results in the free cash flow, which represents the liquidity available for the repayment of financial liabilities (repayment of the loan and interest) and payments to shareholders.

The user has the option to show the cash flow graphics with cumulated or non-cumulated as well as discounted or non-discounted cash flows. The “Discounted cash flow” is discounted, using the effective cost of capital, to arrive at present value estimates, while the “Non-discounted cash flow” does not consider the value of time.

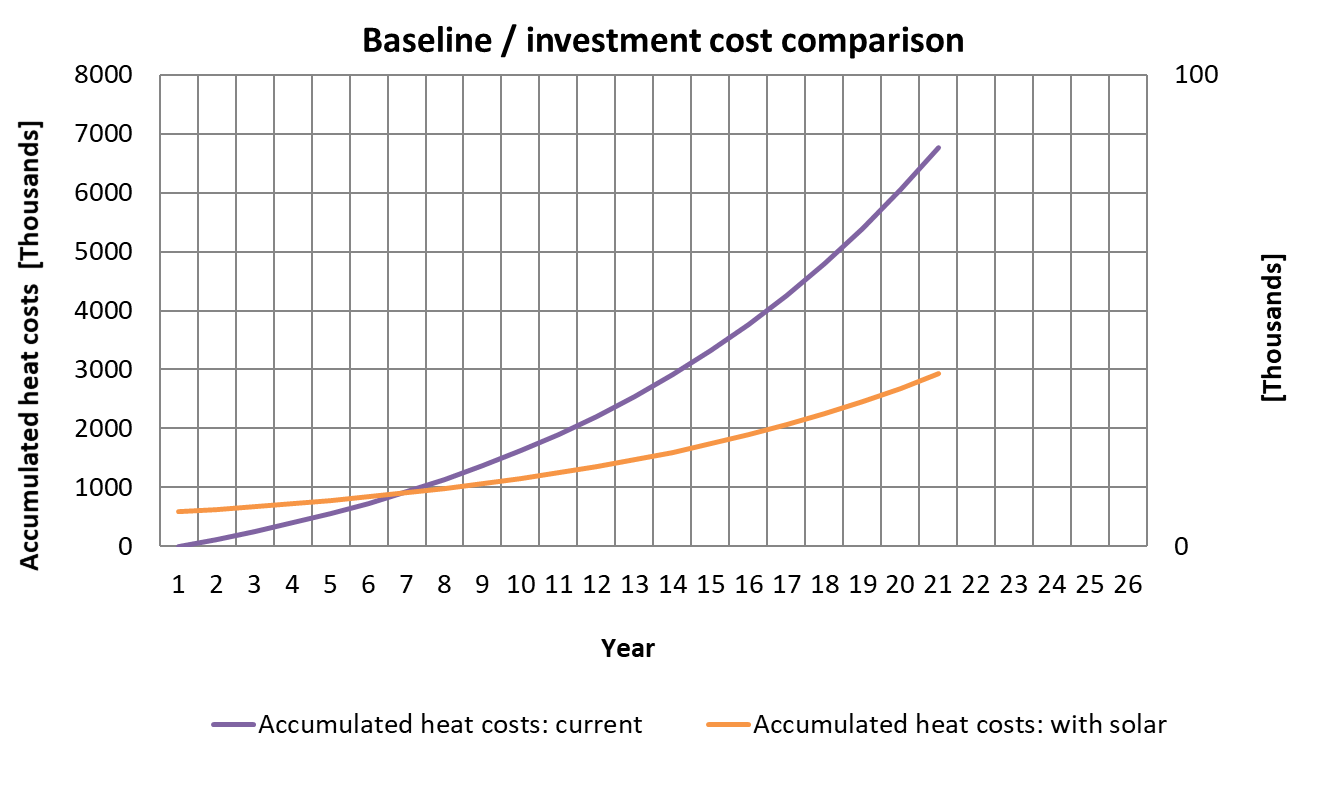

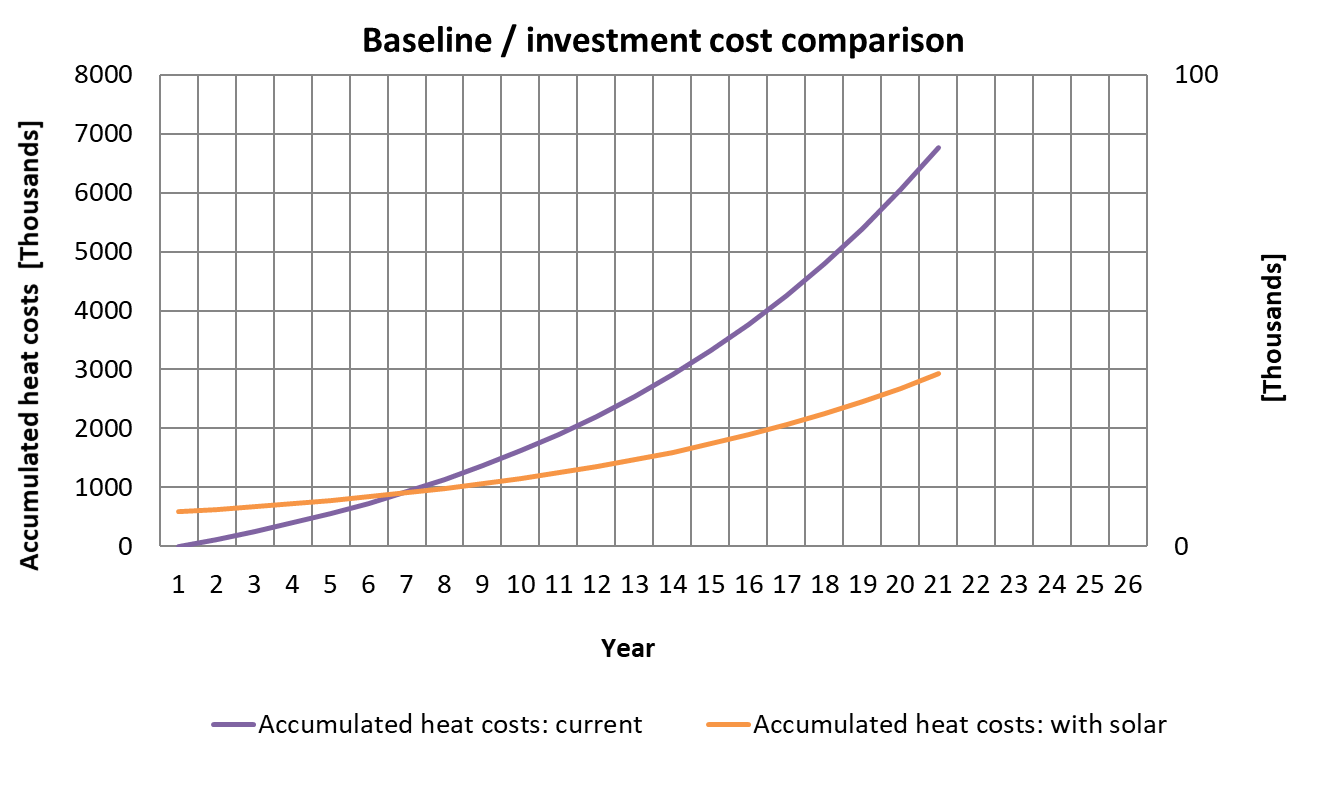

Fig. 17: Baseline / investment cost comparison

Fig. 17: Baseline / investment cost comparison The graphic in Fig. 17 compares the accumulated heat costs of the current system with the accumulated heat costs after the partial substitution by the solar system. Conventional heat costs are adjusted for inflation.

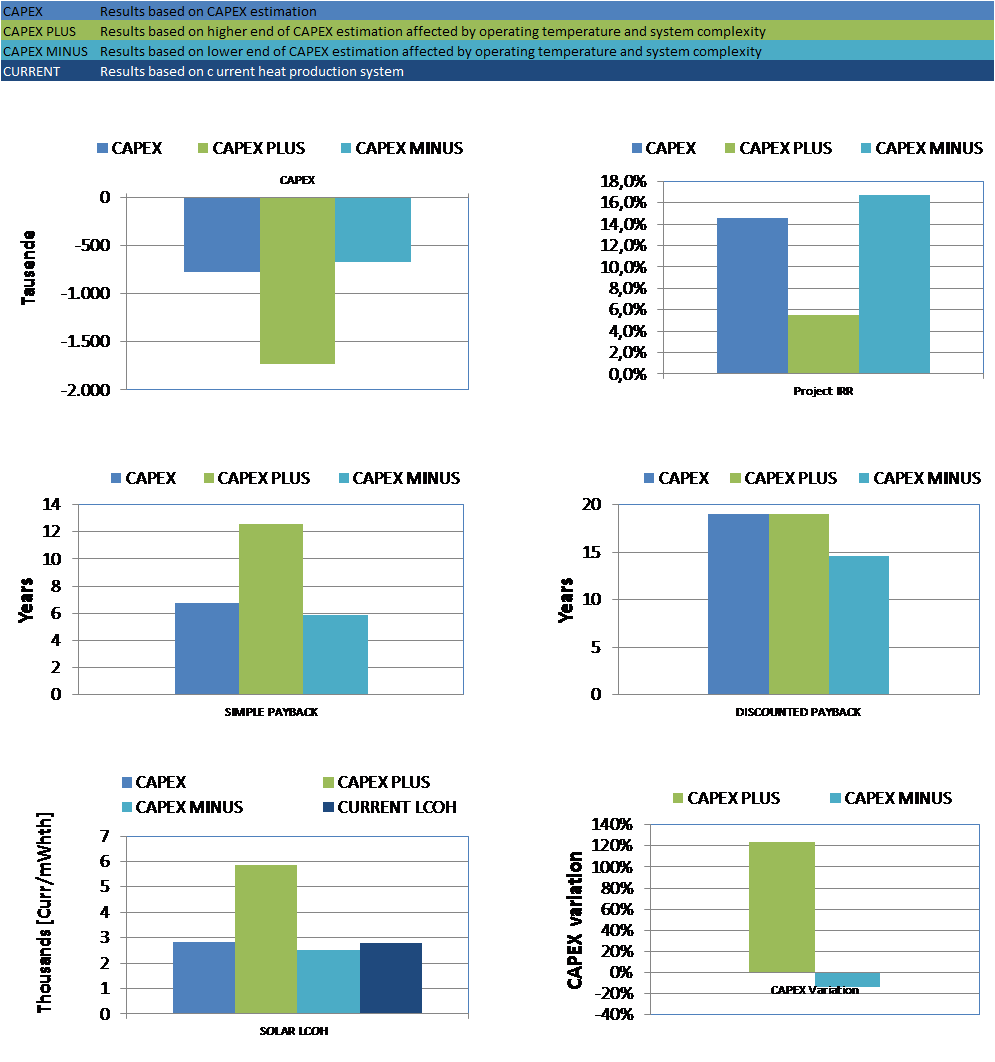

Fig. 18: CAPEX scenarios

Fig. 18: CAPEX scenarios CAPEX – based on average technology costs + on the CAPEX affecting parameters chosen by the user: system complexity, operating temperature and collector technology

CAPEX PLUS – based on average technology costs + on the maximum values of CAPEX affecting parameters chosen by the user: system complexity, operating temperature and collector technology (pessimistic/conservative scenario)

CAPEX MINUS – based on average technology costs + on the minimum values of CAPEX affecting parameters chosen by the user: system complexity, operating temperature and collector technology (optimistic scenario)